|

|

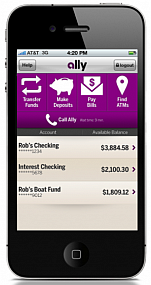

Ally Bank (formerly GMAC Bank) is a branchless FDIC-insured direct bank that provides financial services over internet and phone. It offers certificates of deposit (CDs), checking accounts, online savings accounts and money market accounts with no minimum deposit required to open an account, no monthly maintenance fees and 24/7 live customer service. The Bank also offers retirement savings products and person-to-person payment options. Ally does not offer any personal lending services. Ally Bank is known for its competitive interest yields and its friend customer service. The company was established on August 2, 2004 as GMAC Bank and changed its name to Ally Bank in 2009. Since 2008, Ally has been majority-owned by the United States government. In 2016, Ally Bank was selected as Best Online Bank by Money Magazine for sixth consecutive year. It also was named Best Online Bank in GOBankingRates' Best Banks Rankings. Ally Bank is headquartered in Midvale, Utah and operates as subsidiary of Ally Financial Inc. Ally's deposits are insured by FDIC up to $250,000 per depositor, for each account ownership category. As of March 31, 2018, the company had total assets of $137.5 billion, loans of over $100 billion and deposits of approximately $95 billion. Ally Bank named Best Internet Bank and Best for Millennials by Kiplinger's Personal Finance.

Ally Auto

Ally is one of the top providers of automotive financing in the United States. It offers consumer auto financing through dealers and serves more than 17,000 dealers and over 4 million customers. Ally finances 1 vehicle every 21 seconds nationwide.

Head office address:

6985 Union Park Center, Suite 435

Midvale, Utah 84047, USA

Phone: 877-247-2559

FDIC number: 57803

Routing number: 124003116

Website: www.ally.com

Ally Bank Savings Account Rates

| APY | |

| Online Savings | 1.25% |

Ally Bank Money Market Account Rates

| APY | |

| Money Market | 0.90% |

Ally Bank Checking Account Rates

| APY | ||

| Interest Checking | 0.10% | Daily balance less than $15,000 |

| Interest Checking | 0.60% | Daily balance $15,000 or more |

Ally Bank CD Rates

High Yield Certificate of Deposit

| Term | APY * | APY ** | APY *** |

| 3 months | 0.30% | 0.34% | 0.39% |

| 6 months | 0.60% | 0.63% | 0.67% |

| 9 months | 0.64% | 0.66% | 0.69% |

| 12 months | 1.05% | 1.05% | 1.05% |

| 18 months | 1.20% | 1.25% | 1.30% |

| 3 years | 1.50% | 1.52% | 1.55% |

| 5 years | 1.65% | 1.70% | 1.75% |

* For less than $5,000 opening deposit

** $5,000 min opening deposit

*** $25,000 min opening deposit

Interest Rate and Annual Percentage Yield (APY) as of September 2017.